DETERMINE WHAT YOUR HOME IS WORTH

866.806.4420

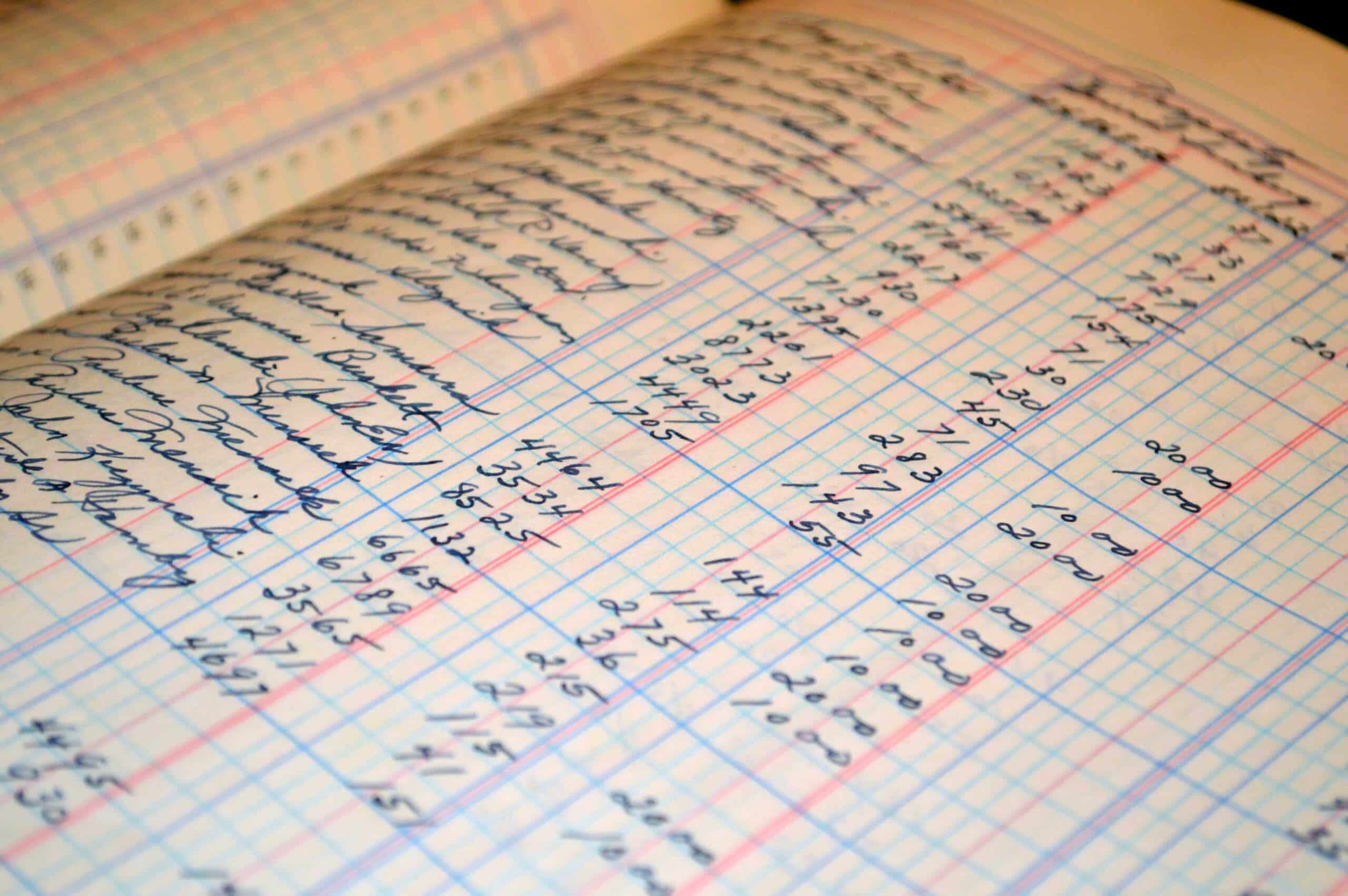

Home financing is one of the most complicated aspects of buying, building and/or owning a house. There are so many things to consider that it can be overwhelming. We aim to help you navigate your most pressing questions so you can focus on the joy of home ownership. From construction loans and mortgage rates to pricing and hidden costs, we’ll cut through the noise and give you the answers you need from industry experts.

When it comes to mortgages, there is a lot at stake. Especially for first-time homebuyers. Picking the wrong one can cost you thousands of dollars in interest payments, and negatively impact your financial future. In this article, we’re covering the ins-and-outs of finding the best mortgage, so you can rest easy knowing you made the right decision.

Think of a new home estimate with a very low price as an iceberg. Like an iceberg, the misleading price is comprised of two parts: the part that’s visible above the surface and the part that’s hidden below the surface. Some home builders minimize the less obvious expenses just to get your business. Hidden costs may not be visible, but they will still impact your plans.

Purchasing an available, pre-owned home from a real estate listing is much different from building a custom house that includes your most desired amenities, especially when it comes to preparing for your property taxes. Without an exact amount based on historical figures, how will you know how much to save up or roll into your mortgage?

You’re thrilled to be building a home. Finally you’ll be able to live in your dream house, complete with all the comforts and features you want. You’ve done your basic research, and are starting to get bids. That’s when you run into an unexpected, seemingly-unexplainable puzzle: The cost-per-square-foot conundrum.